Emerging markets equities had a particularly positive start to 2023, outperforming developed markets on the back of China's reopening in combination with a weakening dollar.

SKAGEN Global

LVMH gains offset by Intuitive Surgical losses; global equities rise on hopes that rates peaking

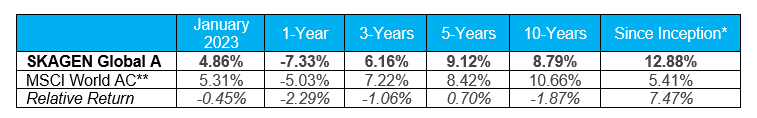

SKAGEN Global gained 4.86% during the month, lagging the MSCI All Country World Index which added 5.31%. Read the SKAGEN Global January 2023 report for more information.

Figures as at 31/01/2023 in EUR, net of fees and annualised for periods greater than 1 year

* Fund inception: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

SKAGEN Kon-Tiki

Chinese holdings drive absolute and relative strength as post-COVID reopening boosts EM

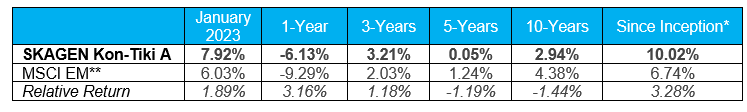

SKAGEN Kon-Tiki climbed 7.92% during the month, beating the MSCI Emerging Markets Index which rose 6.03%. Read the SKAGEN Kon-Tiki January 2023 report for more information.

Figures as at 31/01/2023 in EUR, net of fees and annualised for periods greater than 1 year

* Fund inception: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception

SKAGEN m2

Logistics gains offset by self-storage losses as investors welcome improving economic outlook

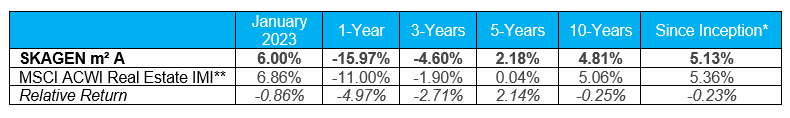

SKAGEN m2 added 6.00% over the month, lagging the MSCI All Country World Index Real Estate IMI benchmark which gained 6.86%. Read the SKAGEN m2 January 2023 report for more information.

Figures as at 31/01/2023 in EUR, net of fees and annualised for periods greater than 1year

* Fund inception: 31/10/2012

** Benchmark was the MSCI ACWI Real Estate IMI ex REITS from 11/07/2017 to 30/09/2019

SKAGEN Focus

Methanex drives absolute and relative gains as KB Financial conviction increases

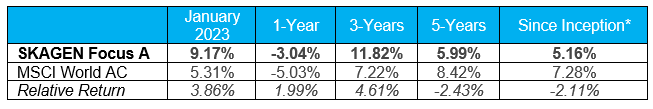

SKAGEN Focus climbed 9.17% during the month, outperforming the MSCI All Country World Index which added 5.31%. Read the SKAGEN Focus January 2023 report for more information.

Figures as at 31/01/2023 in EUR, net of fees and annualised for periods greater than 1 year

* Fund inception: 26/05/2015