With global equities down almost 14% over the nine months to September and on track for their worst calendar year since the financial crisis, 2022 has been painful for stock market investors everywhere[1]. There have been few hiding places; apart from a dozen or so emerging markets, all countries are down year-to-date and every sector apart from energy is in the red[2].

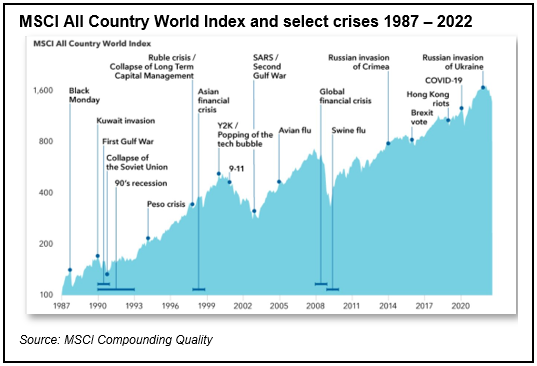

In these difficult periods, it is easy to forget that stock markets have a long history of running hot and cold, and that even the coolest periods are often soon forgotten (see chart). "During severe market downturns, it is important for investors to stay mentally strong," believes Knut Gezelius, Lead Portfolio Manager of SKAGEN Global: "It's impossible to call the bottom but a good deal of froth has been taken out of today's market and like the IT bubble and the Global Financial Crisis, it has a very good chance of recovering strongly after the current energy and inflation crisis."

Watch the latest webinar with Knut Gezelius

Compelling upside

With investors in panic mode for much of 2022 and share prices falling across the board, P/E valuations are now below 30-year averages in all regions, including the US. The S&P 500 currently trades at 15.3x forward earnings, a level which since 1998 has usually been followed by positive returns in the subsequent 12-months and always seen 10-year annualised returns above 7%[3].

SKAGEN Global outperformed the index in the third quarter but is down 21% for the nine months to September[4]. Although painful, this year's drawdown should not cause alarm, particularly following its stellar 40% return in 2021. Despite becoming cheaper, the holding companies have generally reported solid earnings throughout the year – including Q3 so far – making their long-term investment cases even more attractive. The portfolio's forward P/E is now 17x, down from 22x in January, and the upside has increased from 38% to 94% over a 2–3-year investment horizon.

Storm-proof portfolio

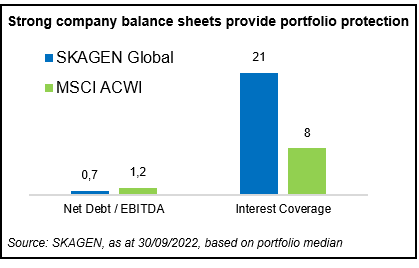

In the current uncertain environment, downside risk is of equal – if not more – importance to investors than upside return. Here, SKAGEN Global looks equally well placed, as Gezelius outlines: "In good times the market routinely overlooks the business model flaws and financial vulnerabilities that tend to be punished harshly during bad times. Our preference is to invest in companies with resilient cash flows and strong balance sheets – 'prepare the ship before the storm' as the saying goes."

Around 40% of the fund's holdings are net cash and 80% can use their free cash flow to become debt-free in three years or less. This translates into a portfolio of companies that are much better positioned to manage their debt on average than those across the broader index (see chart), as Gezelius explains: "We select businesses that are very well capitalised with low levels of debt. We believe the portfolio holdings overall are financially well-equipped to survive an economic downturn and then bounce back once activity recovers."

Knowing when the recovery will happen is trickier, of course. Economies are slowing while central banks are fighting inflation by raising interest rates and the short-term outlook for most companies is challenging. While this has hurt share prices, particularly of growing businesses, Gezelius believes history suggests the future could quickly turn more positive: "Previous cycles show that once inflation expectations peak, stock markets tend to turn upwards fairly violently before central banks pivot. The recovery trigger is usually a flattening of market expectations rather than interest rates themselves."

[1] MSCI All Country World Index as at 30/09/2022 in EUR (-20.1%).

[2] Source: MSCI, as at 30/09/2022.

[3] Source: J.P. Morgan, at as 30/09/2022 in USD.

[4] As at 30/09/2022 in EUR.