Le contenu de cette page relève de la communication marketing

SKAGEN Performance Update – A Resurgent Second Quarter

Markets rebounded sharply as fears surrounding the COVID-19 crisis gradually eased and economies began to open up after the unprecedented shutdowns. The Dow Jones Industrial Average index recorded its strongest quarter in 33 years and the MSCI Emerging Markets index delivered its largest quarterly gain since 2009.

SKAGEN Global

US holdings drive strong absolute gains as global equity markets rebound sharply

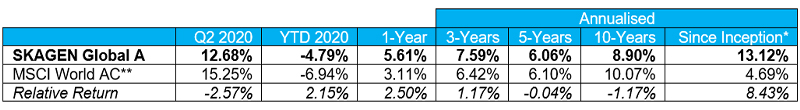

SKAGEN Global A increased 12.68% over the quarter, underperforming the MSCI All Country World Index which climbed 15.25%.

Figures as at 30/06/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

SKAGEN Global is a high conviction, active equity fund which aims to generate long-term capital growth by investing in undervalued companies from across the globe.

Quarterly Report: Read the SKAGEN Global Q2 2020 report for more informationSKAGEN Kon-Tiki

Absolute and relative gains led by holdings experiencing structural growth as EM equities outperform

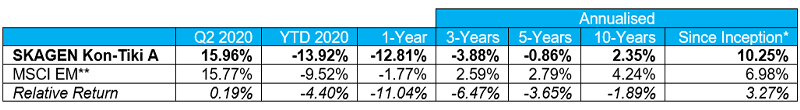

SKAGEN Kon-Tiki A was up 15.96% during the quarter, outperforming the MSCI Emerging Markets Index which rose 15.77%.

Figures as at 30/06/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception

SKAGEN Kon-Tiki is a highly active, global emerging market equity fund which seeks to generate long-term capital growth through a high conviction portfolio of companies which are listed in, or have significant exposure to, developing markets.

Quarterly Report: Read the SKAGEN Kon-Tiki Q2 2020 report for more informationSKAGEN m²

European holdings drive solid absolute return as US data centre operator Switch enters portfolio

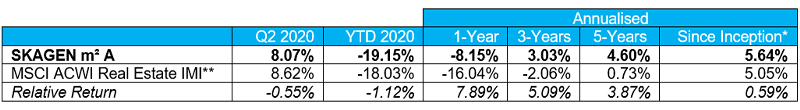

SKAGEN m² A climbed 8.07% during the quarter, underperforming the MSCI All Country World Index Real Estate IMI benchmark index which was up 8.62%.

Figures as at 30/06/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 31/10/2012

** Benchmark was the MSCI ACWI Real Estate IMI ex REITS from 11/07/2017 to 30/09/2019

SKAGEN m² is a long-only, actively managed real estate fund that seeks to generate long-term capital growth by investing in listed property companies from across the globe.

Quarterly Report: Read the SKAGEN m² Q2 2020 report for more informationSKAGEN Focus

Mining stocks drive strong performance as value and smaller companies poised for recovery

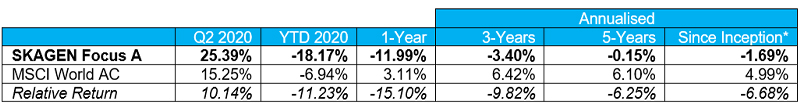

SKAGEN Focus A rose 25.39% over the quarter, outperforming the MSCI All Country World Index which climbed 15.25%.

Figures as at 30/06/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

SKAGEN Focus is a high conviction, active equity fund that seeks to generate long-term capital growth by investing in a portfolio focused on small and mid-cap companies from across the globe.

Quarterly Report: Read the SKAGEN Focus Q2 2020 report for more information