Le contenu de cette page relève de la communication marketing

SKAGEN Performance Update – A Solid Third Quarter

The rotation into value gathered momentum in the third quarter, benefitting our concentrated global equity fund SKAGEN Focus in particular

SKAGEN Global

Logistics strength offset by insurer weakness as global equity markets continue their advance

SKAGEN Global A increased 3.85% over the quarter, underperforming the MSCI All Country World Index which was up 4.59%.

Figures as at 30/09/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

SKAGEN Global is a high conviction, active equity fund which aims to generate long-term capital growth by investing in undervalued companies from across the globe.

Quarterly Report: Read the SKAGEN Global Q3 2020 report for more information

SKAGEN Kon-Tiki

South Korean holdings drive absolute and relative gains as emerging markets outperform

SKAGEN Kon-Tiki A was up 5.84% during the quarter, outperforming the MSCI Emerging Markets Index which rose 4.75%.

Figures as at 30/09/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund’s inception

SKAGEN Kon-Tiki is a highly active, global emerging market equity fund which seeks to generate long-term capital growth through a high conviction portfolio of companies which are listed in, or have significant exposure to, developing markets.

Quarterly Report: Read the SKAGEN Kon-Tiki Q3 2020 report for more information

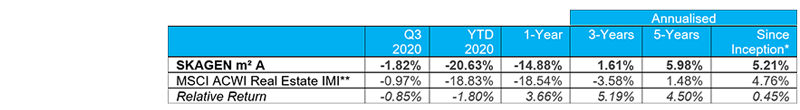

SKAGEN m²

Absolute and relative weakness as global real estate sector emerges from cornonavirus ashes

SKAGEN m² A fell 1.82% during the quarter, underperforming the MSCI All Country World Index Real Estate IMI benchmark index which dropped 0.97%.

Figures as at 30/09/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 31/10/2012

** Benchmark was the MSCI ACWI Real Estate IMI ex REITS from 11/07/2017 to 30/09/2019

SKAGEN m² is a long-only, actively managed real estate fund that seeks to generate long-term capital growth by investing in listed property companies from across the globe.

Quarterly Report: Read the SKAGEN m² Q3 2020 report for more information

SKAGEN Focus

Materials holdings drive absolute and relative strength as value rotation gathers momentum

SKAGEN Focus A climbed 9.11% over the quarter, outperforming the MSCI All Country World Index which added 4.59%.

Figures as at 30/09/2020 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

SKAGEN Focus is a high conviction, active equity fund that seeks to generate long-term capital growth by investing in a portfolio focused on small and mid-cap companies from across the globe.

Quarterly Report: Read the SKAGEN Focus Q3 2020 report for more information

IMPORTANT INFORMATION

All contribution figures are based on NOK returns at the fund level.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on market developments, the fund manager’s skill, the fund’s risk profile and subscription and management fees. The return may become negative as a result of negative price developments.

This message is only intended for the recipient and may contain confidential or other private information.