Le contenu de cette page relève de la communication marketing

Tackling climate change: A SKAGEN perspective

Environmental, social and governance (ESG) factors are increasingly important in investment decision-making. We look at how tackling climate change creates opportunities and how there are clear benefits to engaging with companies.

The growing importance of environmental, social and governance (ESG) factors in investment decision-making has been one of the twenty first century’s greatest successes. As institutional ownership of companies has grown, our collective conscience has also evolved and doing business in an ethical and sustainable way has become increasingly vital to attract both customers and capital.

A few dissenters remain, but most investors now firmly believe that strong ESG principles are a source of competitive advantage, as well as helping to raise living standards and protect the planet. Corporate sustainability should logically create brand equity and operational efficiencies, boosting sales and reducing costs to maximise shareholder value. Research[1] indeed shows that the best ESG-rated companies have significantly higher return on equity (ROE) and lower share price volatility.

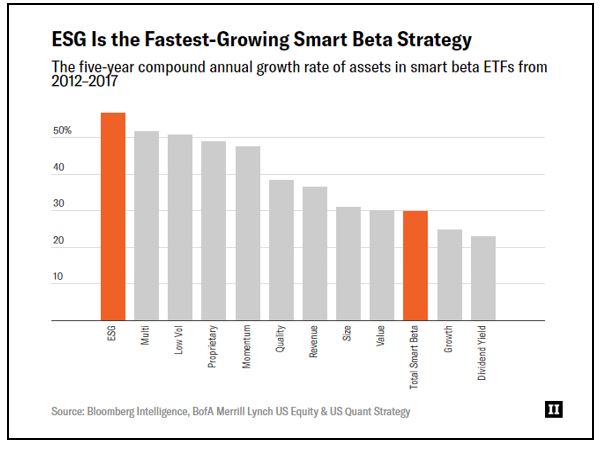

This translates into superior share price performance. A recent Morningstar report[2] concluded that integrating ESG information into a sample of over 1,000 actively managed global equity portfolios improved returns by up to 30 basis points and reduced risk by c. 15 basis points per annum from 2008 to 2017. More surprising than the outperformance of sustainable investment – Benjamin Graham championed undervalued stocks with credible, long-term business plans over eighty years ago – is that it has taken so long to guide mainstream thinking. However, the recent rise of ESG strategies and products (see chart), and mounting evidence as to their benefits, point to a permanent shift in investment opinion.

Political abdication

In many ways, investors are showing politicians the way, particularly in relation to climate change which the UN Principles of Responsible Investing (UNPRI) cites as its highest ESG priority. While Donald Trump has controversially removed the US from the Paris climate change accord – a move critics called an “abdication of American leadership” – investors and asset owners are giving greater significance to how climate change solutions are embedded into their selection processes.

At SKAGEN we believe that active ownership and engagement is the best way to influence positive change and maximise risk-adjusted returns for our clients. Although we avoid the worst polluting companies and those that may incur incalculable liabilities from causing environmental damage, it is important to recognise that climate change is an issue for all companies to varying degrees. It therefore forms a key part of our risk assessment alongside other potential threats to a company’s reputation and valuation.

In relation to climate change, these may take several forms. First, the threat of physical damage caused by severe weather is elevated for agriculture and real estate companies but could impact production facilities and employees in any industry, as well as insurers. Second, legal risks from restrictions on emissions, policy changes on taxation, and litigation costs could impact most companies but are higher for those involved in the extraction – or are heavy users – of fossil fuels. Finally, societal risks could involve consumer boycotts due to negative externalities, such as in the production of palm oil.

Companies exposed to these threats are often cheaply valued but for good reason; they are unsustainable and lack any viable catalyst for a revaluation. The lack of upside potential is compounded by the downside risk of owning a ‘stranded asset’ which becomes costlier to run than it generates in revenue and ultimately has to be written-off.

The challenges faced by investors are often exacerbated by regulatory uncertainty and inconsistent company disclosure, in addition to the time and costs involved in assessing these complicated risk factors. SKAGEN's portfolio managers continuously monitor their investments by analysing company information, screening media reports and through direct dialogue with companies and their representatives.

We also have an online tool specifically for monitoring sustainability issues which analyses a company's ESG impact and ability to manage it. The portfolio managers can then assess how closely companies adhere to international norms and principles. At a portfolio level the funds are also systematically screened, evaluated and documented for ESG-related issues on a quarterly basis.

Environmental opportunities

Fortunately, tackling the issues associated with climate change also presents investment opportunities. An example is Samsung SDI, a 2.0% position in SKAGEN Kon-Tiki, which is one of the world’s largest manufacturers of the rechargeable batteries used in electric cars manufactured by BMW, Volkswagen and Chrysler. Demand for the Korean company’s products is expected to grow as technology develops while drivers and governments seek more eco-friendly vehicles.

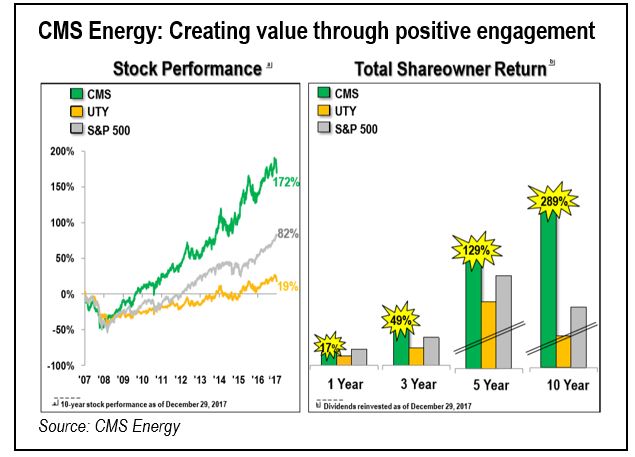

Another holding, CMS Energy (1.5% of SKAGEN Global) illustrates how company engagement on environmental issues can drive a re-rating. Following our investment in the US electricity and natural gas provider, we pushed for improved communication and more detailed financial information of its ‘go green, go cheaper’ strategy. The company responded positively by upgrading its corporate communication materials and contacting key investors, initiatives which saw the company ranked 14th out of 226 global energy providers by Sustainalytics and have contributed to superior long-term equity performance versus peers (see chart).

Virtuous investment circle

Public companies generally are increasingly expected to disclose their climate change policies and performance against these to investors, who in turn must be prepared to communicate how environmental risk management is embedded into their investment process. As with other ESG factors, a demonstrable link between climate change and financial returns means that pension funds and other institutional investors have a fiduciary duty to factor climate risk into their own decision making, even if, at present, there may be no legal requirement to do so. This is likely to have wide-ranging influence across investment strategy, asset allocation, manager selection and stewardship activities.

Even if politicians around the world unite and prioritise a fight against global warming, the role of asset owners and their managers will remain critical in holding companies to account and driving positive change. As always, change creates opportunity for active investors, particularly those with a value focus who can identify the relative winners as ESG standards converge. For the companies and their shareholders who are able to drive sustainable improvement, the long-term rewards are likely to be significant, both environmentally and financially.

[1] How Can Active Managers Put ESG To Work, 10 May 2018

[2] Source: Nordea Markets, FactSet, MSCI, as at September 2017

IMPORTANT INFORMATION

Except otherwise stated, the source of all portfolio information is SKAGEN AS as at 30 April 2018. Data has been obtained from sources which we deem reliable but whose accuracy is not guaranteed by SKAGEN.

Statements reflect the writer's viewpoint at a given time, and this viewpoint may be changed without notice. This article should not be perceived as an offer or recommendation to buy or sell financial instruments. SKAGEN AS does not assume responsibility for direct or indirect loss or expenses incurred through use or understanding of this article. Employees of SKAGEN AS may be owners of securities issued by companies that are either referred to in this article or are part of a fund's portfolio.