Le contenu de cette page relève de la communication marketing

Performance Update Q4 2017

SKAGEN Performance Update – Fourth quarter gains

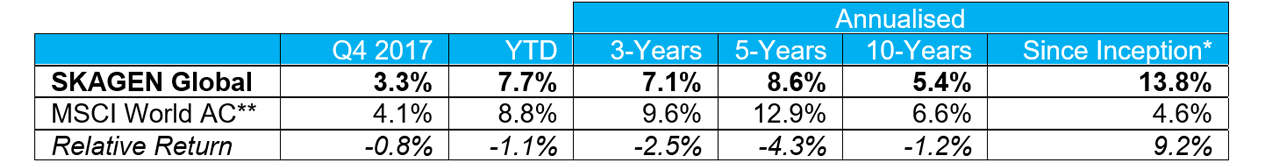

SKAGEN Global A

Solid absolute gains but relative performance hit by US underweight as tax reforms lift domestic equities SKAGEN Global gained 3.3% during the quarter, lagging the MSCI All Country World Index which climbed 4.1%.

Figures as at 30 September 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

- Microsoft was the top performer as the US software giant beat market expectations with solid cash flow generation and strong results from its cloud-based business. Compatriot 3M was the next largest contributor with the global conglomerate boosted by the improving economic outlook in emerging markets.

- The pharma sector provided the two largest detractors; US-based Merck was hurt by study delays for its key cancer drug while Roche was weak due to greater perceived risks to the Swiss multinational's long-term earnings from generic drugs and biosimilars.

- Four new holdings entered the portfolio with Intercontinental Exchange joining in December – we expect the US trading platform to deliver earnings growth and margin expansion from its data business – following the addition of DSV, RELX Group and ThyssenKrupp earlier in the quarter.

- We exited from Merck, Roche, Toyota Industries and G4S during the quarter in order to fund our new investments.

- The portfolio remains attractively valued with average upside of 20% for the top 35 holdings*.

Quarterly Report: Read the SKAGEN Global Q4 2017 here (pdf)

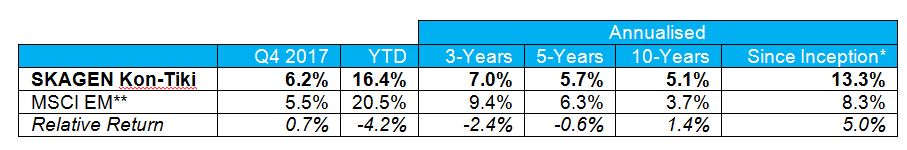

SKAGEN Kon-Tiki A

Strong absolute and relative returns as emerging markets continue to outperform SKAGEN Kon-Tiki increased 6.2% in the quarter, outperforming the MSCI Emerging Markets Index, which was up 5.5%.

Figures as at 31 December 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund's inception

- Naspers was the best performer, boosted by the South African media company's 33% ownership of Chinese Tencent, whose share price more than doubled over 2017. Golar LNG was the next largest contributor with the liquefied natural gas shipping company buoyed by higher oil prices and carrier rates as well as strong third quarter results.

- X5 Retail Group was the worst performer with the Russian grocer impacted by short-term margin pressure and a competitor needing to raise capital. Banrisul was the second largest detractor, weighed down by controlling state shareholder Rio Grande do Sul deciding to reduce its stake in the Brazilian bank.

- Two new entrants joined the portfolio; Russian retailer Lenta, where we expect rising consumer confidence and real incomes to boost sales, and Chinese Hollysys, which we expect to benefit from growing process and factory automation.

- We exited from SBI Holdings, Golden Ocean and CNH Industrial following strong share price performance and several smaller holdings where the risk/reward profile has deteriorated, including Norwegian Air Shuttle, Massmart and Tech Mahindra. The fund now consists of 44 holdings.

- The portfolio remains attractively valued with average upside of 30% for the top 35 holdings*.

Quarterly Report: Read the SKAGEN Kon-Tiki Q4 2017 here (pdf)

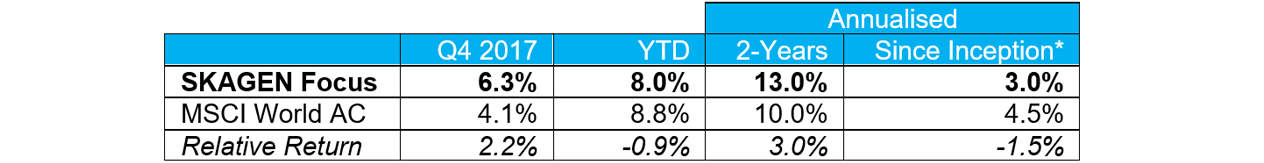

SKAGEN Focus

Strong absolute and relative returns as gains from largest holding offset Italian drag SKAGEN Focus climbed 6.3% during the quarter, outperforming the MSCI All Country World Index which added 4.1%.

Figures as at 31 December 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

- SBI Holdings was the strongest performer as investors begin to recognise the value in the block chain infrastructure asset base of the Japanese financial conglomerate which is now the fund's largest holding. Omega Protein was the next best contributor following a bid for the US-based nutrition company from Canada-based Cooke Inc. at a 32% premium.

- Two Italian companies, UniCredit and Telecom Italia, provided the biggest drag on performance, negatively impacted by growing political uncertainty ahead of the country's elections in March.

- Four new holdings entered the portfolio with the recent additions of South Korean Hanil Cement and Asia Cement – we expect both companies to benefit from consolidation in the domestic cement market – following new investments in Sao Martino and Tachi-S earlier in the quarter.

- We exited from three positions with the sale of Omega Protein (see above) in addition to Adient and Taiheiyo Cement which reached our share price targets.

- The portfolio remains attractively valued with an average upside of 55% for the top 10 holdings*.

Quarterly Report: Read the SKAGEN Focus Q4 2017 here (pdf)

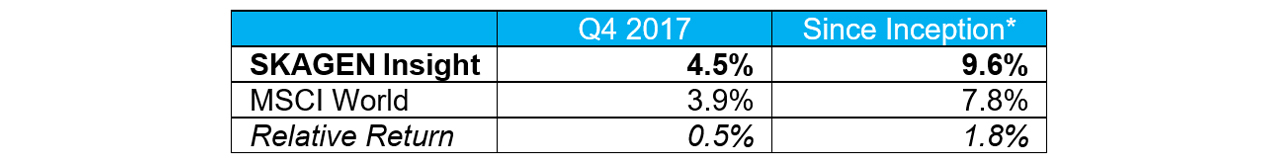

SKAGEN Insight

Absolute and relative gains supported by solid operational performance across the portfolio SKAGEN Insight increased 4.5% over the quarter, outperforming the MSCI World Index which added 3.9%.

Figures as at 31 December 2017 in EUR and net of fees

* Inception date: 21/08/2017

- Buffalo Wild Wings was the best performer following a takeover offer for the US-based sports bar chain by private equity company Roark Capital at our target price. Ericsson was the second largest contributor, boosted by improving results as the Swedish telecom giant continues its turnaround.

- Diebold Nixdorf was the biggest detractor with the US ATM provider hurt by a profit warning from one of its peers, followed by Dormkaba Holding as the Swiss security group gave up some of its recent share price gains.

- Two companies departed the fund with the sale of Buffalo Wild Wings (see above) alongside Nomad Foods, where we followed principal activist investor, Pershing Square, in exiting the European frozen food company.

- The portfolio is attractively valued with our holdings trading on average c. 20% below their 3-year highs and average upside of 55% for the top 10 positions over a two to three-year investment horizon.

Quarterly Report: Read the SKAGEN Insight Q4 2017 here (pdf)

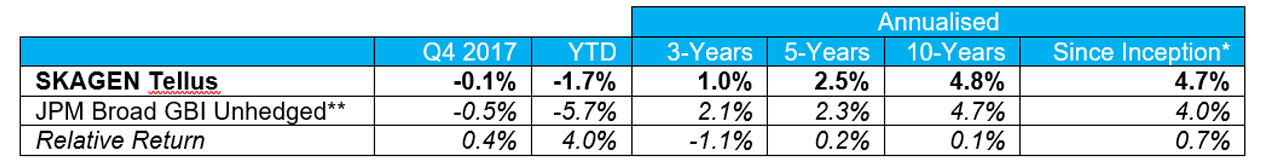

SKAGEN Tellus

New Greek investment drives relative outperformance as portfolio duration remains low SKAGEN Tellus lost 0.1% in the quarter, outperforming the JPM Broad GBI Unhedged index which was down 0.5%.

Figures as at 31 December 2017 in EUR, net of fees and annualised for periods greater than one year

* Inception date 26/05/2015

** Before 01/01/2013 benchmark was Barclay's Capital Global Treasury Index 3-5 years

- Our Greek bond was the largest contributor, boosted by the government's debt swap programme which allowed investors to transfer into new larger bond issues and the country's improving economic outlook. The fund's Portuguese holding was the next best performer with strong economic and fiscal performance continuing to drive down long-term bond yields.

- Our Mexican bond was the worst performer, hurt by uncertainty over the NAFTA renegotiations and a government corruption scandal. Norway provided the next largest detractor, hurt by a strengthening NOK as concerns remain over the potential economic impact from falling house prices.

- Two new holdings entered the portfolio with Uruguay and Greece joining the fund as we exited from Croatia due to uncertainty over its largest retailer Agrokor.

- The portfolio duration is currently 4.4 years, which is substantially below the index (7.8 years). We only take interest rate risk in countries where there is a strong case for a fall in the interest rate and/or the yield is very attractive.

Quarterly Report: Read the SKAGEN Tellus Q4 2017 here (pdf)

----------

* Potential upside based on internal price targets over a two-year investment horizon.

All contribution figures are based on NOK returns at the fund level.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on market developments, the fund manager's skill, the fund's risk profile and subscription and management fees. The return may become negative as a result of negative price developments.