This is a question that preoccupies the numerous investors that have started incorporating ESG factors in recent years. The trend has been clear and the number of signatories to the United Nations supported Principles for Responsible Investing (PRI) has swelled from approximately 60 to more than 1,700 over the past 11 years. Similarly, assets tied to ESG strategies have experienced an average annual growth rate of 25 percent during the same period, reaching some USD 68 trillion today. It is clear that many investors approach their portfolios with a view to doing good while doing well.

Still, until recently there has been little more than scant anecdotal evidence that incorporating ESG factors has a direct, positive impact on the financial returns.

Important study

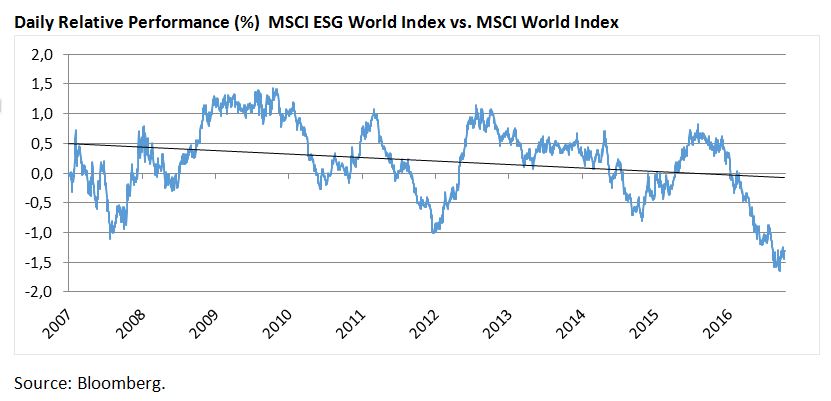

A quick review of historical data, from providers such as Bloomberg, shows no clear connection between best-in-class ESG and outperformance. In fact, over a 10-year period, the MSCI World ESG Leaders Index underperformed the MSCI World Index by 132 basis points. The long-term relative performance has also trended downwards.

That is why MSCI ESG's paper entitled Can ESG add alpha? was so well received when it was published just over two years ago. The paper analysed stock returns of two different ESG strategies constructed using their own data.

For the first, they selected a so-called ESG Tilt strategy, which overweighted stocks with higher ESG ratings. The strategy assumed a link between top ESG scores and future stock performance. In other words, it assumed that companies that already integrate ESG considerations into their operations, and get top marks for doing so are able to avoid certain financial pitfalls, such as fines or labour disputes.

The second strategy, which they called ESG Momentum, was overweight stocks with improving ESG ratings. The premise of this strategy is that future stock performance is linked to a change in the ESG quality of the company and thus also a reduction in potential future liabilities, which is eventually discounted by the market. Picking companies with improving ESG fundamentals requires a fund manager to identify specific key ESG triggers, as well as potential timing of these triggers.

A clear preference

One example of the ESG Momentum strategy is when a company's management has expressed a desire to improve corporate governance or embark on a more sustainable business strategy. Such a move often makes the company more receptive to advice from investors.

Current positions in the portfolios of SKAGEN Global and SKAGEN Kon-Tiki whereby the companies have expressed willingness to improve corporate governance include G4S, CMS Energy and Samsung Electronics.

In the case of CMS Energy, a US-based utility company, a new management team decided to significantly reduce its dependence on coal in favour of renewable energy. The company's CEO Patti Poppe has said that the state of Michigan is at "an inflection point" and the company can now "determine what kind of energy we want to supply for the next hundred years." As a result of this, many of its coal-fired plants have been closed.

Still, many investors have doubted management's commitment to phasing out old, expensive coal-fired plants, and the stock slid almost 14% between July and December 2016, when the Norwegian sovereign wealth fund placed CMS Energy on its watch list for potential exclusion. SKAGEN Global initiated the position during December last year, as illustrated in the graph below.

Frustrated by the lack of understanding and traction among international investors, CMS management contacted SKAGEN Global to ask for input to their strategy and how to communicate the changes better.

The input provided by the SKAGEN Global team contributed to sharply improve CMS Energy's ESG score and stock performance in 2017:

As the CMS Energy case demonstrates, companies that embark on new, improved ESG strategies are often met with initial scepticism among investors. Many investors prefer instead to invest in those companies with a proven ESG record, those in the ESG Leader index. This index includes the highest ESG-rated companies and excludes companies within the fields of alcohol, gambling, tobacco, nuclear power and weapons.

An exclusion strategy may well be an efficient way of removing unwanted potential investment risks, particularly in the case of an index fund. However, given SKAGEN's active stock picking philosophy, our preference is typically for those companies that are embarking on their ESG journey.

Improvers perform

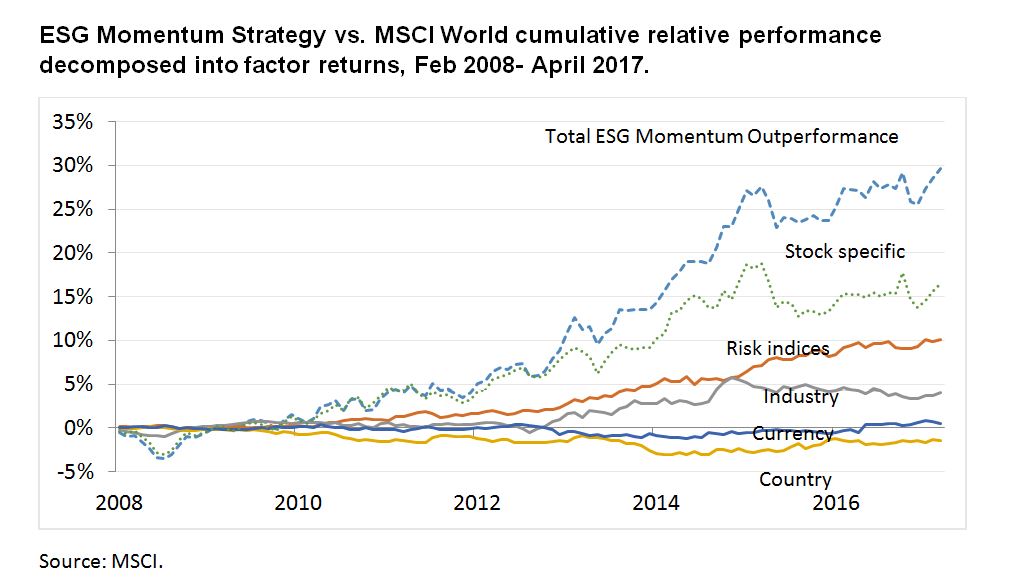

MSCI recently updated its study to explore whether improving ESG scores still translate into superior performance over time. The study showed that while exclusion may be a simple way of screening a potential investment universe and avoiding the most obvious pitfalls, the strategy of picking improvers outperformed the global equity market over time. The cumulative returns for the ESG Momentum Strategy over the MSCI World index was a total of 29.6 percent over the past 10 years.

The graph below breaks down the outperformance into systematic factors and stock-specific contribution. The sum of factor returns equals total outperformance.

Stock-specific returns, i.e. returns that are not explained by systematic factors, make up about half the cumulative outperformance. These returns have also been relatively stable over the last two years. Conversely, the data shows that the country and currency factors have been negative contributors historically.

A significant source of alpha

Based on the updated MSCI study, one can therefore conclude that positive ESG momentum can be a significant source of alpha over time. In addition, picking the right stocks on a positive ESG path is a major source of outperformance. It is therefore clear that the data in the study supports active stock picking and integration when considering ESG.

The implications of this are two-fold. Firstly, that companies with less than perfect ESG scores have more improvement potential and should therefore be included in a fund's investment universe, and that the study advocates an integrated ESG approach where fundamental analysis includes ESG considerations.

This chimes well with SKAGEN's investment philosophy of finding mispriced stocks where we can see clear catalysts for revaluation, including ESG factors.

Read more about SKAGEN's approach to ESG in the investment process.

Sources:

USSIF: Global Sustainable Investment Review 2016 (PDF)

UNPRI: UN supported Principles for Responsible Investment

MSCI: MSCI World ESG Leaaders Index (USD)

MSCI: Can ESG Add Alpha? An Analysis of ESG Tilt and Momentum Strategies