Le contenu de cette page relève de la communication marketing

Performance Update Q1 2018

SKAGEN Performance Update – A turbulent first quarter

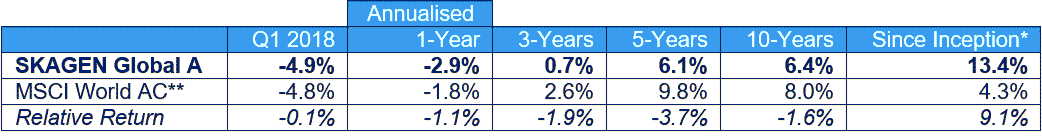

SKAGEN Global

Strong results from European holdings as fund performs in-line with volatile global equity market. SKAGEN Global A fell 4.9% in the quarter, slightly underperforming the MSCI All Country World Index which lost 4.8%.

Figures as at 31 March 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 07/08/1997

** Before 01/01/2010 benchmark was MSCI World Index

- Autoliv was the largest contributor with the Swedish auto safety and technology company's strong results reflecting its success in developing airbag inflators. UK insurer Beazley was the next best performer, delivering impressive profitability despite several natural catastrophes during 2017.

- Citigroup was the main detractor as the US bank fell in tandem with the market despite delivering better than expected results. Compatriot 3M was the next largest drag on performance with the conglomerate experiencing a slower than expected start to the year.

- Three new holdings were added during the quarter: Hong Kong-listed Shangri-La, the recovering hotel operator with attractive Chinese exposure; Japanese conglomerate Nissan Chemical, which focuses on high value-add niche areas in electronics, specialty chemicals and pharma; and US technology company Adobe, which has strong market positions in content creation and digital marketing.

- Four companies left the fund with Lundin Petroleum (target price achieved) and China Mobile (regulatory concerns) exiting in March, following the departures of Skechers and Red Electrica earlier in the quarter.

Quarterly Report: Read the SKAGEN Global Q1 2018 Report here (PDF)

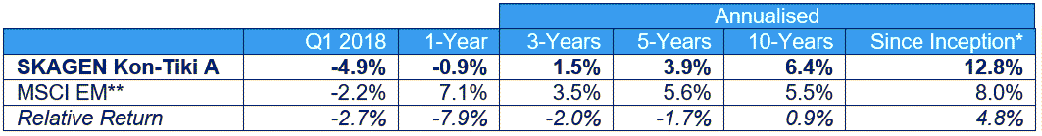

SKAGEN Kon-Tiki

Brazilian and Chinese strength amid emerging market weakness as economic recovery continues SKAGEN Kon-Tiki A decreased by 4.9% during the quarter, lagging the MSCI Emerging Markets Index which was down 2.2%.

Figures as at 31 March 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 05/04/2002

** MSCI EM Index (net total return) did not exist at the inception of the fund and consequently the benchmark index prior to 1/1/2004 was the MSCI World AC Index. This is not reflected in the table above which shows the MSCI EM Index since the fund's inception

- Banrisul was the top performer as the Brazilian bank announced strong results with improving asset quality and the potential flotation of its credit card business. China Shineway was the next largest contributor, boosted by better than expected results and growing investor awareness of the traditional Chinese medicine producer.

- State Bank of India was the largest detractor, impacted by weak results with continued poor asset quality. Hyundai Motor was the next worst performer as the Korean car manufacturer delivered similarly disappointing figures.

- Four new companies joined the portfolio with the addition of Aeroflot, Sinotrans, Bank of China and Beijing Enterprise Water in January; all are attractively valued on an absolute and relative basis with solid yield support of 3-7%.

- Two companies left the portfolio due to strong share price performance with Johannesburg Stock Exchange departing in March following the exit of Eczacibasi Ilac at the start of the year.

- The portfolio remains attractively valued with the top 35 holdings (91% of assets) trading on a weighted P/E of 9x and P/BV of 1.1x.

Quarterly Report: Read the SKAGEN Kon-Tiki Q1 2018 Report here (PDF)

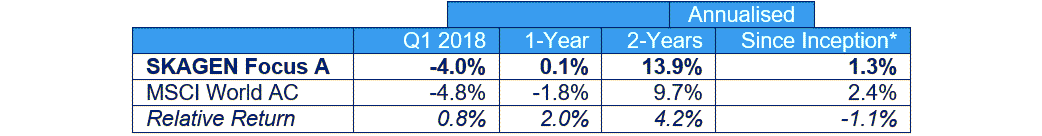

SKAGEN Focus

Asian strength drives relative outperformance as fund makes new US company investments. SKAGEN Focus A fell 4.0% over the quarter, outperforming the MSCI All Country World Index which dipped 4.8%.

Figures as at 31 March 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date: 26/05/2015

- Fila Korea was the top performer as the South Korean sportswear producer delivered strong results driven by its golf equipment business and continued domestic recovery. SBI Holdings was the next largest contributor with growth in the trading of domestic equities helping the Japanese financial services group to deliver impressive results.

- Swiss baker Aryzta was the largest drag on performance after lowering full-year guidance due to continued weakness in its US operations. AIG was next largest detractor as the US insurer reported another disappointing quarter following its recent acquisition of reinsurer Validus.

- Five new positions were initiated during the quarter including US companies, Avaya Holdings Viacom and Hawaiian Holdings.

- Four companies exited the fund with the March disposal of Arytza following the departures of Andeavor, Stocks Spirits and Taiheiyo Cement in January.

Quarterly Report: Read the SKAGEN Focus Q1 2018 Report here (PDF)

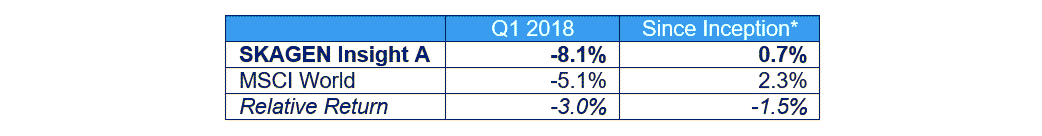

SKAGEN Insight

Strong performance from US holdings as portfolio sees encouraging operational progress. SKAGEN Insight A fell 8.1% in the quarter, behind the MSCI World Index which dropped 5.1%.

Figures as at 31 March 2018 in EUR and net of fees

* Inception date: 21/08/2017

- Conduent was the top performer as the US business process services company announced results ahead of expectations and improved forward guidance. Cognizant was the next largest contributor with the US IT services firm boosted by strong operational trends and impressive execution to deliver better than anticipated results.

- Armstrong Flooring was the largest detractor as the US company's turnaround continues despite challenging market conditions. German industrial group ThyssenKrupp was the next weakest performer, weighed down by negative investor sentiment despite delivering solid results.

- Five new companies joined the portfolio with the addition of Katakura Industries, GEA Group, Shire, Banca Popolare di Sondrio and Hudson's Bay.

- Eight companies left the fund due to strong share price performance with Stewart Information Services and Iluka Resources departing in March following the exits earlier in the quarter from Deckers Outdoor, Baxter, Stock Spirits, Terex, Morgan Stanley and CBRE.

- The portfolio remains attractively valued, trading on a P/E (T+3) of 10.0x compared to 13.3x for the broader market.

Quarterly Report: Read the SKAGEN Insight Q1 2018 Report here (PDF)

SKAGEN Tellus

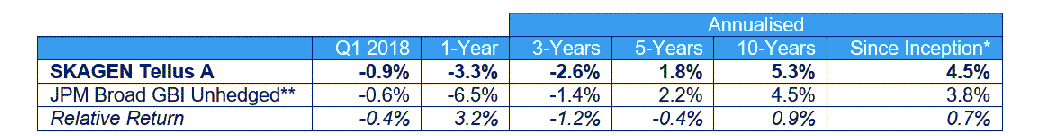

Bond market volatility as fund's JPY underweight drives relative weakness despite Mexican strength. SKAGEN Tellus A dipped 0.9% over the quarter, underperforming the JPM Broad GBI Unhedged index which lost 0.6%.

Figures as at 31 March 2018 in EUR, net of fees and annualised for periods greater than one year

* Inception date 26/05/201529/09/2006

** Before 01/01/2013 benchmark was Barclay's Capital Global Treasury Index 3-5 years

- Our Mexican bond was the largest contributor as increased hopes of an agreement on NAFTA triggered lower yields and a stronger peso. The fund's Portuguese, Spanish and Norwegian holdings also performed well.

- The Dominican Republic provided the biggest detractor, with our local currency bond impacted by higher interest rates and a weakening peso despite the economy performing well. Our Uruguayan bond was the next worst performer with yields rising in line with higher inflation.

- The fund's relative performance was hurt by our underweight position in Japan, where we have zero exposure, as the yen appreciated strongly against the euro.

- We exited from Slovenia where we see limited upside following strong performance over several years and reduced our holdings in Canada, Peru and the Dominican Republic (USD-denominated bond).

- The fund's duration is 4.3 years, substantially below the index (7.9 years). We have low duration in countries whose currencies we believe are undervalued relative to the euro and higher duration where yields are attractive.

Quarterly Report: Read the SKAGEN Tellus Q1 2018 Report here (PDF)

_______________________________________

All contribution figures are based on NOK returns at the fund level.

Historical returns are no guarantee for future returns. Future returns will depend, inter alia, on market developments, the fund manager's skill, the fund's risk profile and subscription and management fees. The return may become negative as a result of negative price developments.

This message is only intended for the recipient and may contain confidential or other private information.