As concerns grow over the health of the global economy and the likelihood of entering recession, finding safe havens for investors to preserve their wealth – particularly in the face of rising inflation – has become harder. Despite a challenging start to 2022, the investment case for investing in a conservative and diversified portfolio of listed property assets has rarely been stronger.

Global real estate is down 15.2% year-to-date, slightly lagging global equities which have lost 14.7%[1]. Reflecting the localised nature of underlying property assets, regional performance has varied considerably with REITs in the Middle East and Africa up 1.8% in 2022 while Europe has fallen 24.1% into bear market territory[2].

In addition to fears of economic slowdown, real estate has been hit by interest rates rising rapidly around the world as central banks attempt to fight off inflation. As well as increasing borrowing rates for developers – many of whom are also facing higher construction costs – this has made the relatively generous dividend yields generated by REITs less attractive to investors.

Nordic real estate is amongst the biggest laggards; Norway is down 26% year-to-date while Sweden is 40% lower[3]. In Sweden, where the broader stock market has fallen 23%[4], there are worries that rising interest rates and bond yields will force a large number of real estate operators to refinance up to $15 billion of debt and sell assets.

Despite being overweight in Europe, SKAGEN m2 is in step with its global benchmark year-to-date, thanks to strong stock selection. With the outlook for the second half of the year remaining cloudy, the fund's diversified and conservative portfolio means it is well-positioned for a range of different scenarios.

Superior stock picking

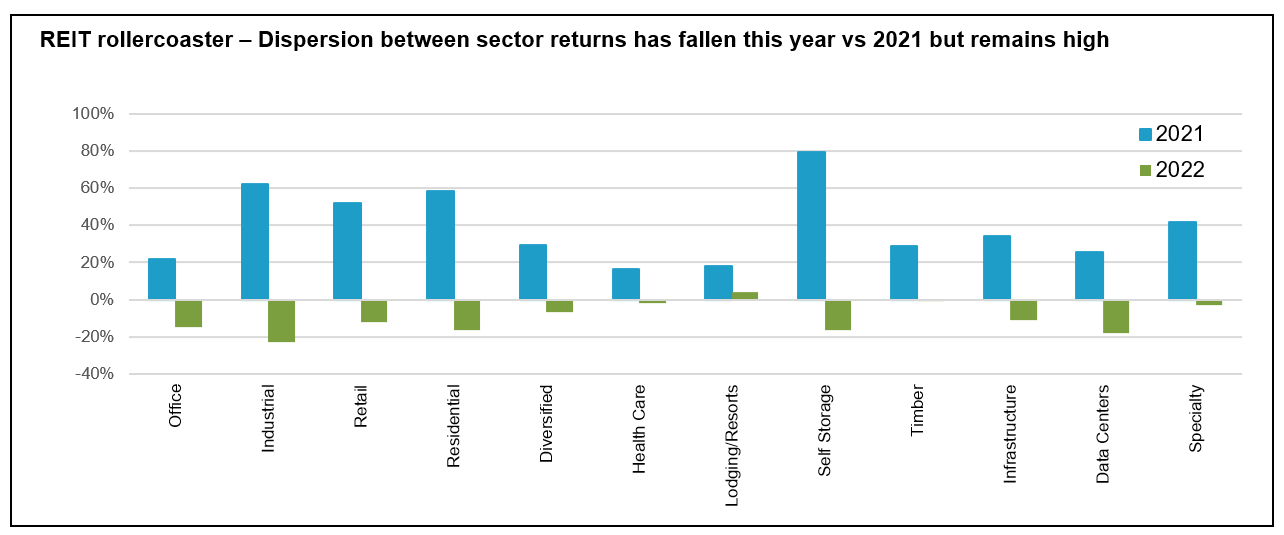

The global listed real estate market is highly diverse with often large differences in performance between different sub-sectors and countries. A look at global REIT performance for the past 18 months illustrates the variance between segments and also within the same segment over different time periods – many of 2021's winners are this year's biggest losers[5].

Such high volatility creates opportunities for active investors to pick-up bargains when valuations fall, particularly if they have the freedom to invest anywhere like SKAGEN m2. Real estate in Sweden, for example, is currently trading at a 41% discount to net asset value, compared to a historic average of 2%. Since 2010, similar reductions have been followed by an average 12-month return of 22%, albeit the performance of individual stocks varied significantly.

Sleeping soundly

This illustrates the importance of doing one's homework to find the best ideas, particularly when markets have fallen but significant risks remain. Unlike passive funds, we perform detailed due diligence on each of our investments with assessment of potential macroeconomic, market, ESG and financial threats.

This means we can take comfort in our portfolio companies having solid balance sheets with less debt than the broader market. The fund's 33 holdings have a conservative weighted loan-to-value ratio of 32%, meaning that they should be able to withstand any fall in asset values as well as further rises in interest rates. Their average interest coverage ratio is also relatively high at 8.8x, which means that their debt interest payments can be covered relatively easily by company profits and with room to manoeuvre if circumstances change unexpectedly.

Another key factor to help reduce risk is diversification, particularly when sub-sector and regional returns are weakly correlated. SKAGEN m2's portfolio is more geographically diverse than the index, which currently has 59.4% exposure to US-listed companies, almost double that of our fund (31.8%). Our holdings offer a similar level of sub-industry diversification to the benchmark, albeit we have carefully positioned the portfolio to provide investors with exposure to the recovery from COVID and protection against the economic uncertainty ahead.

We believe that in the current environment, real estate remains investors' best protection against inflation and economic uncertainty. The recent correction also means that listed property is currently undervalued compared to its long-term average, offering attractive upside for existing investors and an exciting entry point for new ones.

Given the risks that remain, careful and conservative stock selection is more important than ever. Combined with a focus on value and the flexibility to find the best ideas, this remains the best way for investors to maximise returns without losing sleep at night.

NB: All data as at 23/06/22 unless stated

[1] MSCI ACWI Real Estate IMI index vs. MSCI All Country World Index in EUR as at 23/06/22

[2] Source: NAREIT. Returns in EUR as at 23/06/22

[3] Source: Norway: OBX Real Estate GR, Sweden: Refinitiv

[4] Source: OMX Stockholm 30 as at 23/06/22

[5] Source: NAREIT