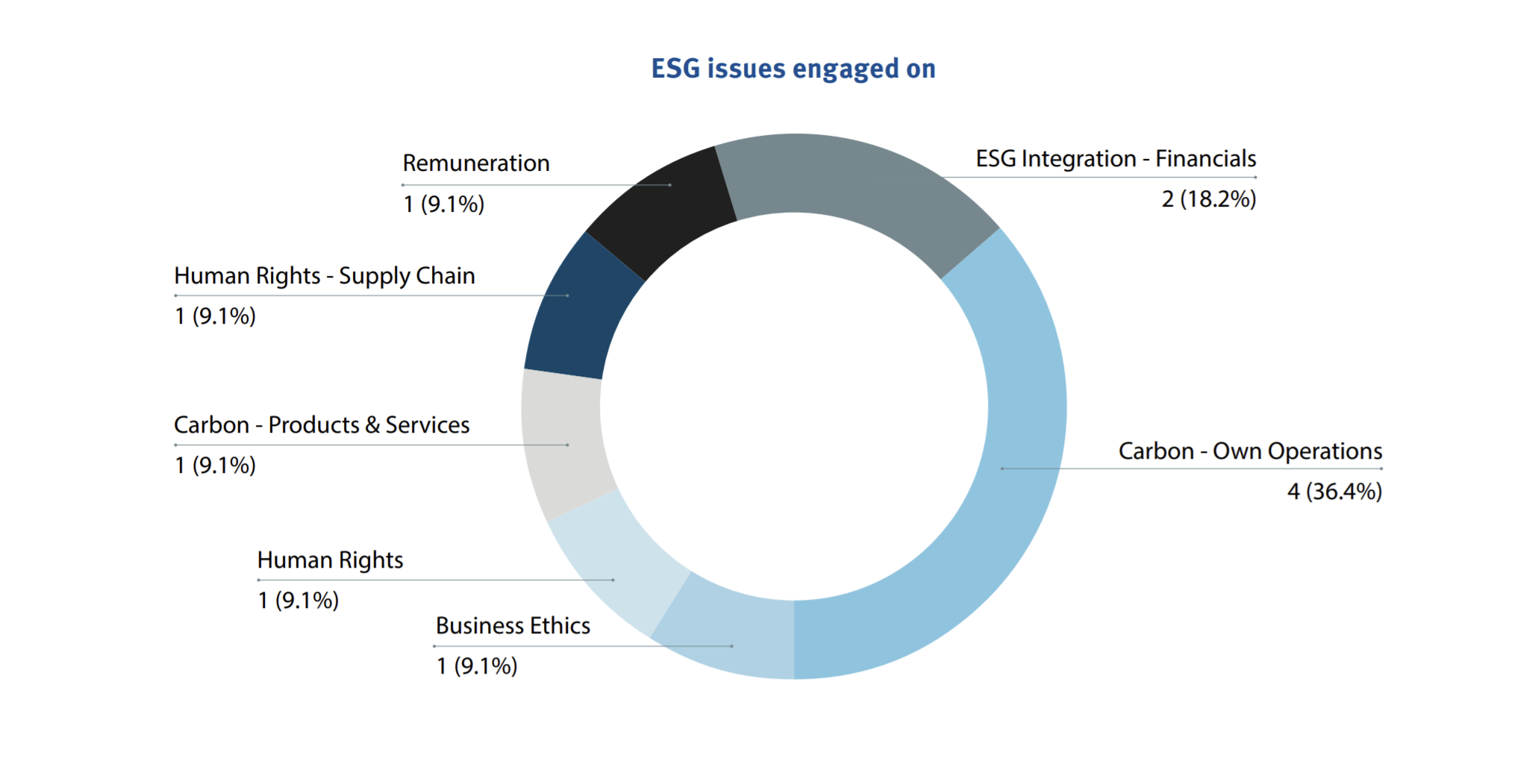

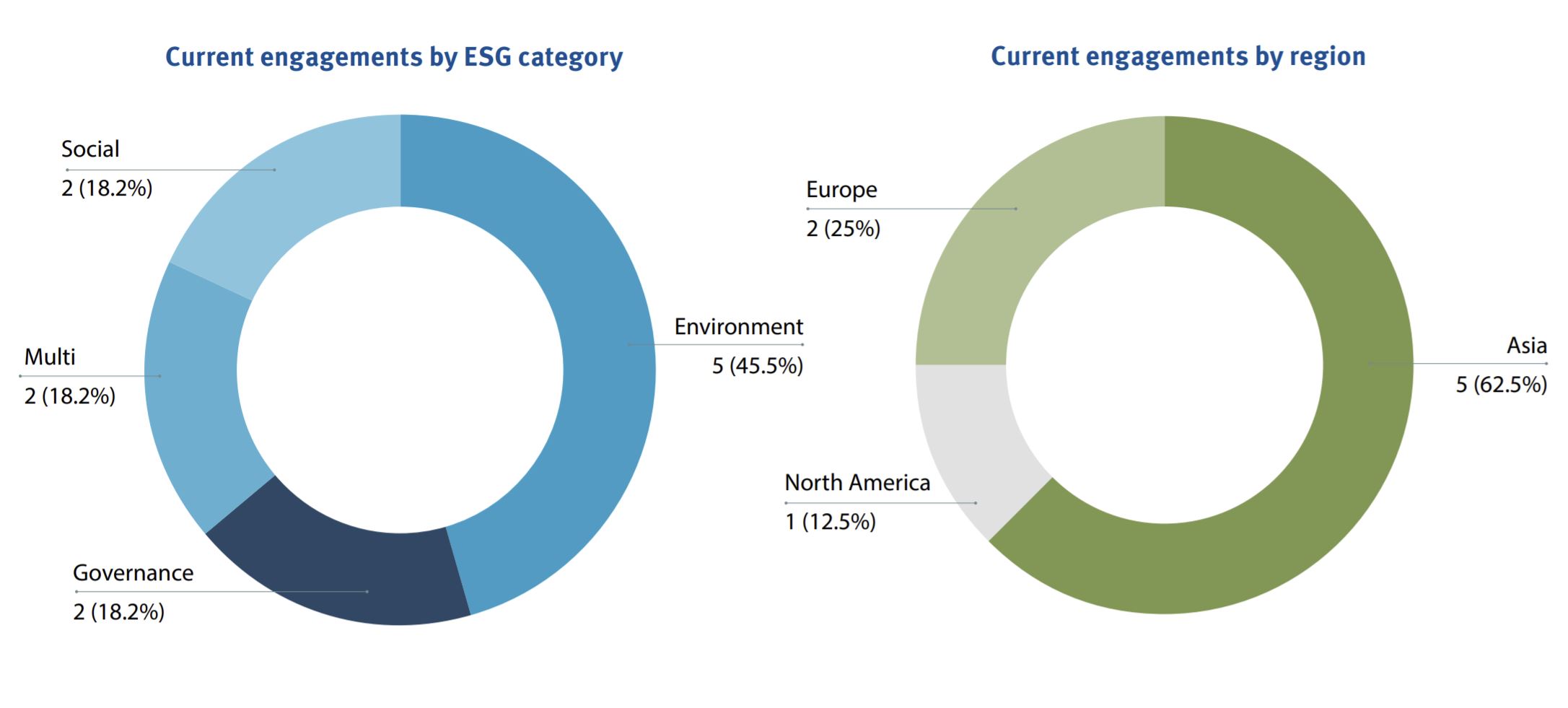

It has been a busy start to 2021; we have engaged with eight companies on 11 unique cases. The majority of the engagement work has involved setting the scene for further dialogue and monitoring. We have covered a wide variety of topics, all of which are linked to company-specific strategies and ambitions. In one particular company engagement, we discussed the potential effects that the introduction of a cap and trade carbon market in China might have on their operations.

In another, we sought to better understand the importance of the company’s commitment to human capital for acquisition and retention of talent. Another topic that featured in our dialogue with companies focused on their plans to add circular features to their business operations. Some actors see the potential to renovate, re-build and upgrade existing machinery for clients and second-hand buyers of their products. For other companies, the circular focus is related to further expanding innovation and investments in order to reduce operational emissions and greenhouse gases. In turn, this often also benefits the total cost picture as well as employee wellbeing and satisfaction.

As active stock pickers

SKAGEN’s portfolio managers have always sought out undervalued companies. While some of these may have a controversial past, they must also demonstrate a willingness to change. As such, we favour companies that create value through improvements related to environmental, social and governance (ESG) factors, amongst others.

Excess return can be generated when companies develop in a positive way, either through our engagement with them or their own improvements. As such, picking the right companies that are on a positive ESG trajectory can be a source of significant outperformance and is in line with SKAGEN’s value-based investment philosophy of finding undervalued companies where we can see clear catalysts for revaluation.

Our approach to sustainable investments is built upon three main pillars: Exclusion, Integration and Active Ownership. Each method is applied in different circumstances and leads to different investment outcomes. The full potential of a sustainable investment strategy is only realised when applying the methods together. Read more here